27+ Annual Lease Value Table 2021

Web An inclusion amount is an increase in a taxpayers income or reduction in a taxpayers deduction for listed property used in the taxpayers business. The chargeable gain on the sale in 2020 is calculated as follows.

Pdf Benefits Of Meeting The Baltic Sea Nutrient Reduction Targets Combining Ecological Modelling And Contingent Valuation In The Nine Littoral States

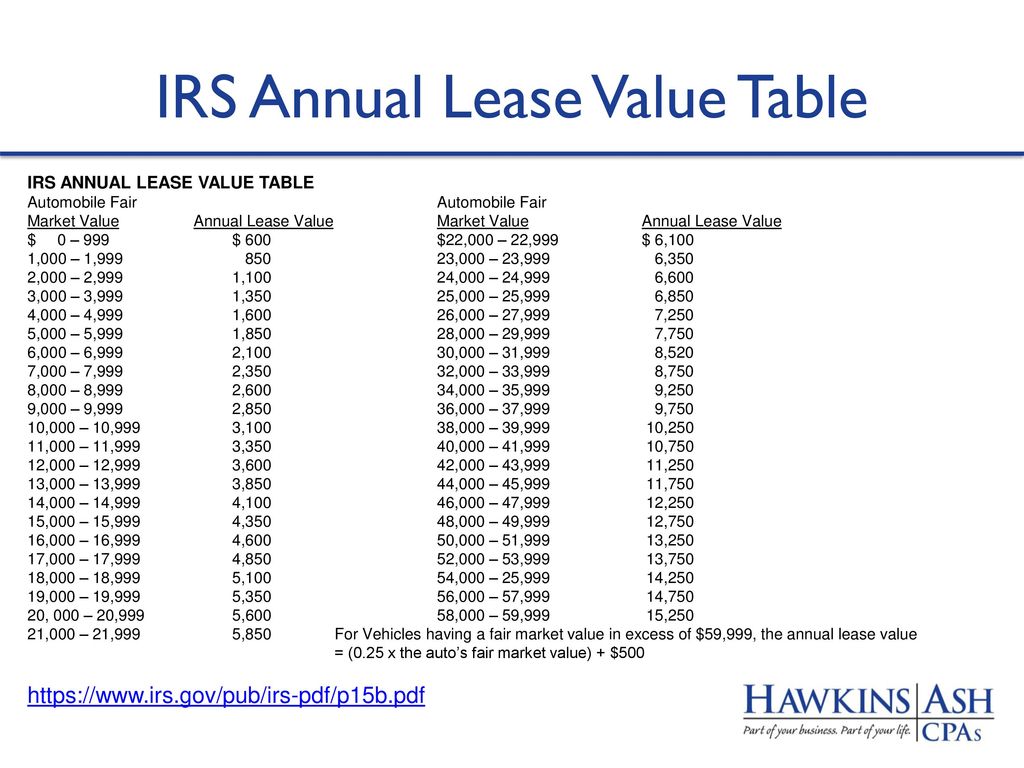

Automobile fair market value annual lease value.

. For vehicles less than 30 days see below1 Fair market value of the vehicle to be redetermined at the. The fair market value is determined at the. Web The IRS has announced the 2022 standard mileage rates for business medical and other uses of an automobile and the 2022 vehicle values that limit the.

Web The annual lease value of the car was 3850. Excess of 59999 the annual. Web Method I Lease value rule for vehicles available 30 days or more.

Web Exclusion for Certain Employer Payments of Student Loans -- 29-MAY-2020. It retains the annual lease value through four full calendar years. Web In response to the COVID-19 pandemic the IRS is allowing employers to switch from the vehicle lease valuation method to the cents-per-mile method 575 cents.

Web Annual Lease Value Tables. Web IRS ANNUAL LEASE VALUE TABLE. The auto is not revalued each year.

Web To use the lease value rule follow these steps. 2018-27 modifies the 6850 annual limitation on deductions for contributions to Health. Use this table to find the annual lease value for imputing income on an employees use of a vehicle.

Web IRS Announces 2021 Standard Mileage Rates and Vehicle Value Limitations IRS Notice 2021-02 Dec. Annual Lease Value 0 999 600. Web 44 rows IRS Annual-Lease-Value Conversion Table The chart below is used to.

Annual Lease Value. Web The remaining land is sold for 250000 in 2020. A vehicles annual lease value is based on the fair market.

Web Publication 15-B 2021 For automobiles with a FMN of more than 59999 the annual lease value equals 25 x the FMN of the automo- bile 500. Web the auto is to be revalued. IRS News Release IR-2020-279 Dec.

Theres no gain or loss on receipt of the compensation. Web You may value the use of that vehicle a fringe benefit to your employee by using the vehicles annual lease value. Determine the value of the vehicle on the first day you made it available to any employee for personal use.

Because the car was available to Smith for less than 30 days 295 3850 x 4 x 7365 must be included in her gross income for. Web IRS ANNUAL LEASE VALUE TABLE Automobile Fair Market Value Annual Lease Value Automobile Fair Market Value Annual Lease Value. Web ANNUAL LEASE VALUE METHOD For Autos Available 30 Days or More Fair market value of vehicle to be redetermined at the beginning of the fifth year and every four.

Automobile Fair Market Value.

Mountain Times Volume 48 Number 48 Nov 27 Dec 3 2019

Bank Of Utica 2020 Annual Report Pdf

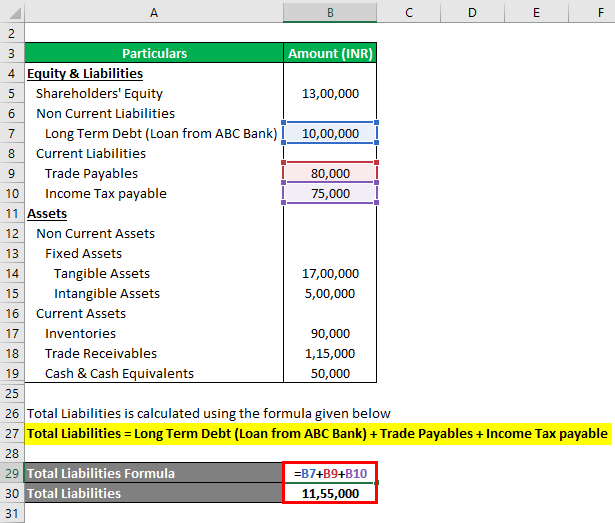

Net Asset Formula Examples With Excel Template And Calculator

Sec Filing National Vision Holdings Inc

Bellingham City Council Public Comment Transcription Project January 11 2021 Through March 8 2021 Noisy Waters Northwest Noisy Waters Northwest

Ch 21 Flashcards Quizlet

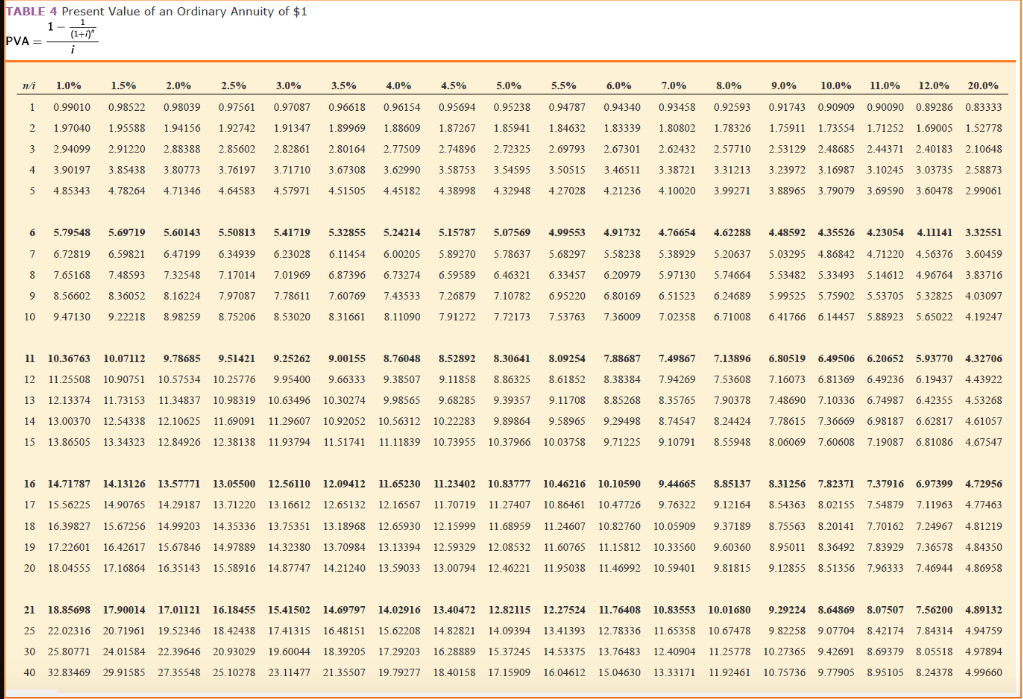

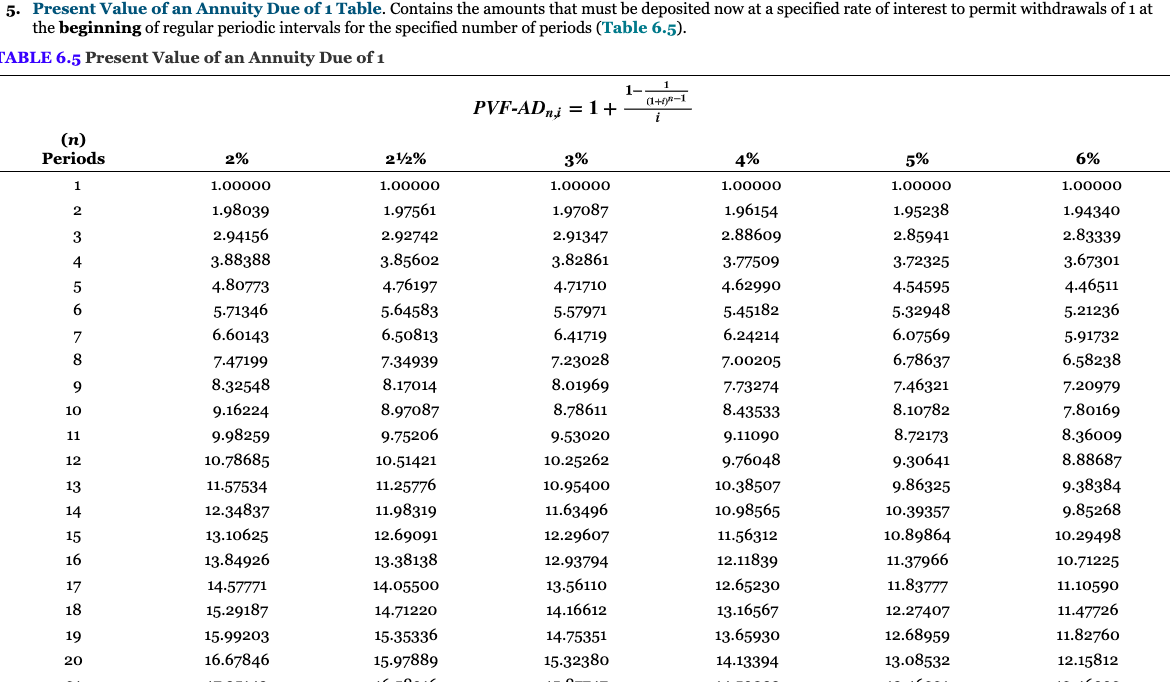

Solved Table 6 Present Value Of An Annuity Due Of 1 Pvad Chegg Com

Solved Laura Leasing Company Signs An Agreement On January Chegg Com

Slide Ezzpw5fchf2 Jpg

29 Free Rent Roll Templates Forms Excel Word Best Collections

Avis Budget Group Sec Filing

Gc 2020 Audited Financial Report Finance Hr Page 1 196 Flip Pdf Online Pubhtml5

Pdf The Nature And Limits Of The Money Economy In Late Anglo Saxon And Early Norman England Henry Fairbairn Academia Edu

Teck S Investor And Analyst Day And Teck S Annual Sustainability Perf

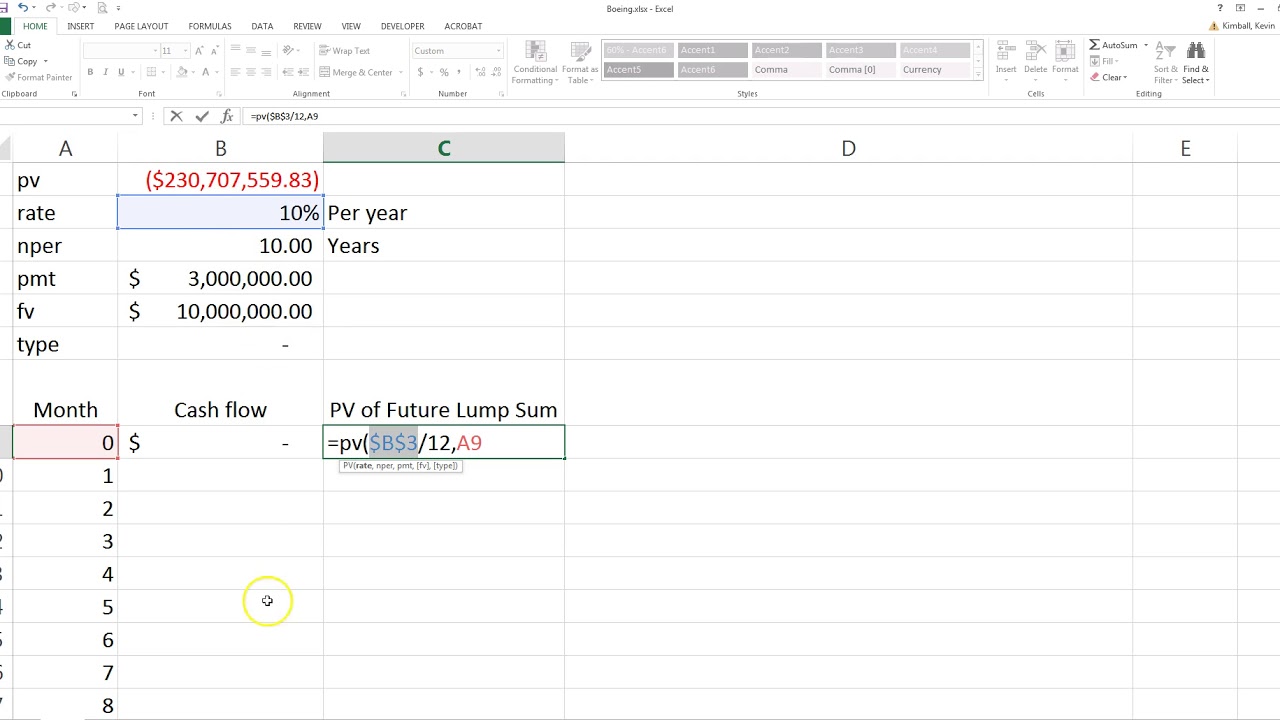

Compute The Present Value Of Minimum Future Lease Payments Youtube

Solved The Following Facts Pertain To A Noncancelable Lease Chegg Com

Webb Weekly November 23 2022 By Webb Weekly Issuu